Palm Coast Local

Locals Helping Locals

Flagler County Tourist Development Tax: What Residents, Visitors, and Property Owners Need to Know

- Details

- Written by: Palm Coast Local

- Parent Category: Business Blog

- Category: Government

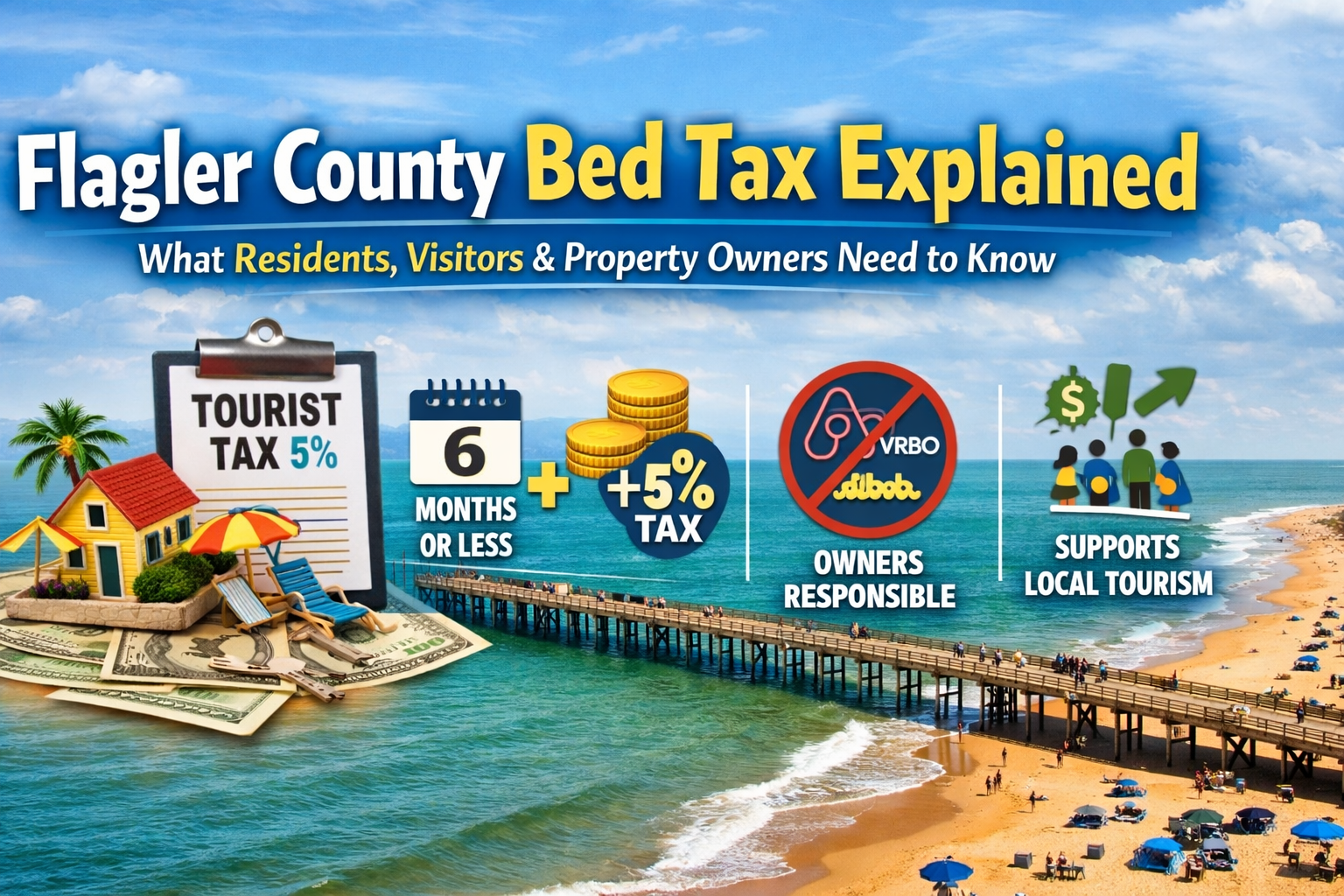

Flagler County Tourist Development Tax AKA: Bed Tax: What Residents, Visitors, and Property Owners Need to Know

If you live in Flagler County, plan to visit, or own property that may be rented short-term, you’ve likely heard the term Tourist Development Tax, often called the bed tax. Understanding how it works is important—not just for compliance, but for transparency in how tourism impacts the local community.

This guide explains what the tax is, who it applies to, how it’s collected, and what property owners should know, in plain language.

What Is the Tourist Development Tax?

The Tourist Development Tax is a 5% local tax applied to short-term rentals of six months or less in Flagler County. It has been in effect since August 1, 2018, under County Ordinance 2018-10.

This tax is separate from and in addition to Florida’s 7% State Sales and Use Tax, which is paid to the state.

The tax applies to a wide range of accommodations, including:

-

Hotels and motels

-

Condos and apartments

-

Single-family and multi-family homes

-

Mobile home and RV parks

-

Cottages and short-term residential rentals

-

Boats permanently docked and used as living quarters

Who Is Responsible for Collecting the Tax?

Any person or business that rents or leases a property for six months or less is responsible for collecting and remitting the Tourist Development Tax to the Flagler County Tax Collector.

This includes:

-

Individual homeowners

-

Investors

-

Property managers

-

Vacation rental operators

Even if a rental is listed on a third-party platform, the responsibility ultimately falls on the property owner.

Important Note About Online Rental Platforms

Flagler County does not have agreements with online rental platforms such as Airbnb or VRBO to collect or remit the Tourist Development Tax.

This means:

-

The platforms do not send the 5% tax to Flagler County

-

Property owners must ensure the tax is properly collected and paid

-

All short-term rentals also require a local business tax receipt, regardless of rental duration

What Charges Are Taxable?

The 5% tax applies to the gross rental amount, which includes most mandatory fees paid by the guest.

Taxable charges include:

-

Nightly or monthly rental rate

-

Cleaning fees

-

Pet fees

-

Mandatory traveler or service fees

Non-taxable charges include:

-

Refundable damage deposits

-

Optional travel insurance

Who Is Exempt From the Tourist Development Tax?

Exemptions apply in limited situations, including:

-

Renters with a bona fide written lease longer than six months

-

Guests who remain continuously for six months (the tax stops beginning month seven)

-

Individuals or organizations exempt from Florida sales tax, such as:

-

Government agencies

-

Active-duty military

-

Full-time students

-

Churches and qualifying nonprofits with exemption certificates

-

When and How the Tax Is Paid

The Tourist Development Tax is filed monthly and is:

-

Due on the 1st of the following month

-

Considered delinquent if not paid or postmarked by the 20th

A return must be filed even if no rental income was collected for that period.

Property owners may file and pay online through Tourist Express, which offers a small collection allowance for timely payments.

What Happens If the Tax Is Late?

If payment is not submitted by the deadline:

-

A 10% penalty applies for each month late (minimum $50)

-

Penalties can reach up to 50% of the tax due

-

Interest accrues at a variable rate

Frequently Asked Questions

Do I need to register even if I only rent occasionally?

Yes. Any short-term rental requires registration and tax reporting, even if rented only part-time.

If I use a rental agent, am I still responsible?

In most cases, property managers file on behalf of owners. However, the property owner remains ultimately responsible if taxes are not paid correctly.

Do I need to collect tax on cleaning fees?

Yes—if the fee is mandatory to stay at the property, it is taxable.

What if friends or family stay at my property?

If you accept rent or compensation of any kind, the tax applies based on the rent paid or fair market value.

What if I didn’t know I was supposed to collect the tax?

The Tax Collector’s office encourages owners to contact them directly. They will work with property owners to bring accounts into compliance.

What if my property is no longer used as a short-term rental?

After submitting a final return, you must notify the Tax Collector in writing so the account can be closed.

Helpful Links:

Sales & Use Tax ID : https://floridarevenue.com/taxes/taxesfees/Pages/sales_tax.aspx

Pay Tax Online: https://flagler.county-taxes.com/tourist

Information is current as of 2025 and subject to change. This content is for informational purposes only and should not be considered legal or tax advice. Always confirm requirements with the appropriate government agencies.

Add comment